All Categories

Featured

Consider Utilizing the penny formula: cent represents Financial obligation, Revenue, Home Mortgage, and Education and learning. Complete your financial obligations, home loan, and university expenses, plus your wage for the number of years your household needs security (e.g., until the children are out of the residence), and that's your protection need. Some economic specialists compute the amount you need utilizing the Human Life Value philosophy, which is your life time revenue potential what you're gaining currently, and what you anticipate to make in the future.

One method to do that is to look for companies with strong Monetary stamina scores. decreasing term life insurance comparison. 8A firm that finances its own policies: Some business can sell policies from one more insurance provider, and this can add an additional layer if you wish to transform your plan or in the future when your family members needs a payout

Voluntary Term Life Insurance Meaning

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

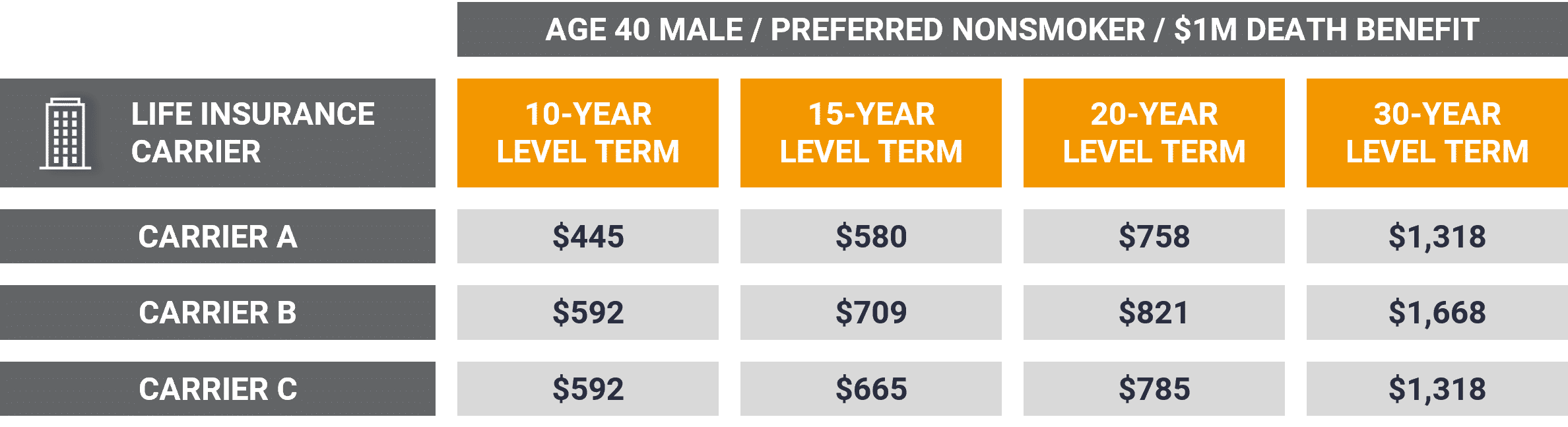

Some firms supply this on a year-to-year basis and while you can expect your rates to climb considerably, it may be worth it for your survivors. An additional means to compare insurance policy business is by taking a look at online client reviews. While these aren't likely to inform you much regarding a firm's financial stability, it can inform you just how simple they are to deal with, and whether insurance claims servicing is a trouble.

When you're younger, term life insurance can be an easy method to protect your loved ones. As life modifications your monetary priorities can also, so you may desire to have whole life insurance for its lifetime protection and additional advantages that you can utilize while you're living.

Approval is assured despite your health. The premiums will not boost once they're set, however they will certainly rise with age, so it's a good concept to lock them in early. Figure out more concerning just how a term conversion works.

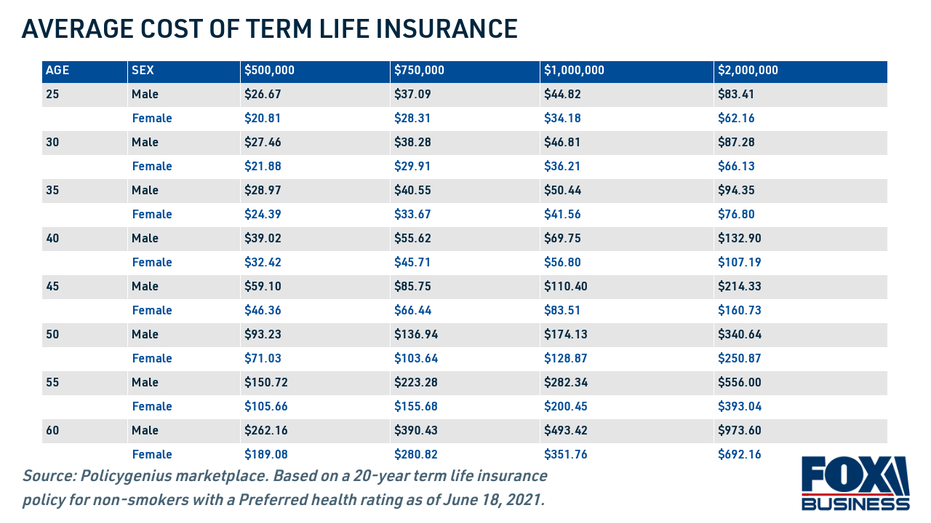

1Term life insurance policy offers short-lived security for a crucial duration of time and is normally cheaper than irreversible life insurance policy. life insurance 10 year term meaning. 2Term conversion guidelines and restrictions, such as timing, may use; as an example, there may be a ten-year conversion benefit for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance Purchase Alternative in New York City. 4Not readily available in every state. There is an expense to exercise this rider. Products and bikers are readily available in authorized jurisdictions and names and functions might vary. 5Dividends are not ensured. Not all participating policy proprietors are qualified for returns. For select bikers, the problem uses to the insured.

Latest Posts

Term Life Insurance Pays Out Dividends

What To Do When Term Life Insurance Expires

Seattle Term Life Insurance